What is an Initial Coin Offering (ICO)?

An initial coin offering (ICO) in the world of cryptocurrency is a mechanism by which a community raises funds for a new cryptocurrency project by selling coins or tokens. It’s like the cryptocurrency version of an Initial Purchase Offer (IPO), although with little of the regulation and legal process that accompanies similar efforts within the regulated financial world.

Techopedia Explains the Initial Coin Offering Meaning

An initial coin offering definition refers to a fundraising method for cryptocurrency projects that are new, in which tokens for the project are sold to investors. Most ICOs exchange the new coin or token for well-established coins, such as bitcoins or ether.

In an initial coin offering, the process starts with a design for a blockchain or protocol project. Startups may circulate white papers and other resources to show potential investors project details. Founders outline the amount of the project’s tokens that will be allocated to investors, often accompanied by a distribution plan for the remainder.

Several well-known crypto blockchains got their start this way, including Ethereum, which sold its ether (ETH) coin for $0.31 during its initial fundraising, exchanging 2,000 ETH for one Bitcoin at the time. ETH later reached an all-time high of nearly $4,900 in 2021.

However, ICOs can be used with protocols as well, such as Wormhole, a blockchain messaging platform that raised $225 million through private token sales.

History of ICOs

The first ICO was in 2013 for Mastercoin, which was later rebranded to Omni Layer and is still in use today, powering projects such as Tether (USDT).

2013 brought several other smaller ICOs, including NextCoin (NXT) and CounterParty (XCP).

Ethereum’s 2014 ICO, the sixth in crypto history, represents one of the most profitable investments in history for early investors. An initial 31-cent ICO price rose to nearly $5,000 at the 2021 peak.

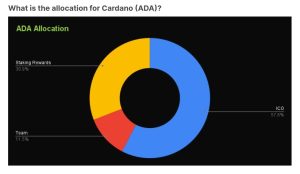

2016 brought the ICO for Cardano, raising more than $62 million and giving ICO investors 57.6% of the ADA supply.

However, like other kinds of early investing, initial coin offerings can be risky.

2017 through 2018 marked the ICO Boom, although many of the ICOs from that period ultimately fell in value. EOS, the largest ICO to date, raised a record $4 billion in 2018. After reaching an all-time high of $22.71 in April 2018, EOS traded below $2 by December of the same year.

Many projects during this period never materialized, causing massive losses for ICO investors.

2017 and beyond led to initial coin offerings reaching into the tens of billions annually. Other notable ICOs include Solana (SOL), one of today’s top blockchain projects by market cap. Funding for the project began in 2018 with a seed sale, raising $3.17 million. Fundraising continued with a Founding Sale, Validator Sale, Strategic Sale, and finally, a Public Auction in 2022, raising nearly $26 million in total.

How Do ICOs Work?

ICOs help novel crypto-related projects raise development funds through the sale of tokens. Investors buy tokens before they reach the broad market, providing operating funds for the project while offering potential profit opportunities for early investors. Many of today’s public ICOs may allow investors to buy tokens directly from the project website or through a platform like Impossible Finance.

The process can vary but often follows a similar pattern for reputable projects.

Private Sale

Typically, private sales require a minimum investment amount. These funds are often used for marketing to help ensure a successful ICO.Presale

Selected or random investors are offered an opportunity to buy before the ICO is opened publicly. Often, presales are only available to accredited investors, meaning those who demonstrate they have the financial means to invest large amounts of money.Crowdsale

The ICO is now openly available to a wider group of investors. Crowdsales typically require identity verification to comply with Know Your Customer (KYC) regulations enforced in many countries around the world.

ICO tokens may come with a lockup period, meaning that investors can’t sell until the lockup expires. However, the specific structure of each offering differs by project.

ICO vs. IPO

Initial coin offerings are often compared to initial purchase offerings (IPOs), the latter of which is used in the stock market. While similar in function, with both being used to raise capital, ICOs and IPOs differ in several key aspects.

Regulation

Largely unregulated

Ownership

Sell tokens, the utility of which (or lack thereof) can vary greatly from project to project

Project Structure

Often decentralized, no ownership

Turnaround Time

Days or weeks

Regulation

Must comply with SEC requirements

Ownership

Provide partial ownership of the company

Project Structure

Centralized, ownership by shareholders

Turnaround Time

Time-consuming, regulatory approval required

Types of ICO

There are two basic types of initial coin offerings: private and public. However, there are some additional structures and strategies that we’ll also discuss.

- Private ICOs: In a private ICO, access is limited, often only including high-net-worth individuals (HNWI) and accredited investors. Security token offerings (STOs) often follow this model. Security tokens represent financial assets designed to share profit or pay a yield.

- Public ICOs: In a public ICO, the structure works more like a crowdfunding model, allowing anyone to participate and purchase tokens before they reach the broad market.

Whether public or private, there’s still the question of how the tokens reach the market. Several strategies exist.

As an alternative to a formal ICO, projects can also launch tokens on a decentralized exchange (DEX). This strategy called an IDO or initial DEX offering, involves pairing minted tokens with another cryptocurrency in a liquidity pool. This provides easy access for investors while allowing the project to raise funds.

ICO Examples

Ethereum remains one of the most illustrative examples of a successful ICO. However, several other projects raised more through their ICOs and upcoming ones are also doing quite well.

EOS

Launched at the height of the ICO Boom of 2017 to 2018, EOS raised a record-breaking $4 billion in its ICO. However, development fell short of expectations, and the SEC assessed a $24 million penalty against Block.one, the company behind the EOS network, in 2019.

The community formed the EOS Network Foundation in 2021. The EOS community now controls the blockchain’s code, hoping to revive the project.

Cardano

Founded in 2015 by former Ethereum cofounder Charles Hoskinson, Cardano had its ICO in 2016, launching the ADA token that now powers the network. With each ADA priced at $0.0024 at the ICO, the fledgling project raised $62 million in funding. By the time the token became tradable, prices reached $0.02, a 10x return for early ICO investors. Today, ADA trades in a range between $0.50 and $0.60, having reached an all-time high of over $3.00 in 2021.

Telegram

The encrypted messaging app that serves as a hub for crypto users and other communities launched its ICO in 2018. The presale was for GRAM tokens, with the funding slated for the development of the Telegram Open Network (TON). In total, $1.7 billion was raised. However, US regulators from the SEC won an injunction preventing the planned launch of the network. In 2020, Telegram settled with the SEC, agreeing to return $1.2 billion to investors and pay a fine.

In 2019, Telegram released the code for TON as open source. Today, the TON blockchain is live, and the not-for-profit TON foundation is focused on supporting and developing the network.

ICO Pros and Cons

ICOs offer a new and still-evolving way for investors to find opportunities and for crypto projects to raise capital for development. However, ICOs have pros and cons.

Pros

- Provide fast and easy access to capital for new projects

- Allow investors to gauge public interest when making investment decisions

- The online sales of tokens make ICOs available to a global audience

Cons

- Regulatory uncertainty over how tokens will be classified creates investment risk

- The ICO space has a reputation for scams and projects that never launch

- In most cases, investors have little or no recourse if a project fails to deliver

ICO Regulations

ICOs remain unregulated in most parts of the world. However, regulatory enforcement may come before or after the fact if agencies such as the US SEC deem the ICO to be a security.

Both China and South Korea have banned crypto ICOs, although they remain legal throughout most of the world. Still, regulatory uncertainty over the classification of ICOs creates risks for both projects and investors. Exchanges also face risks, as tokens deemed to be securities by agencies like the SEC can lead to costly fines for trending platforms selling the tokens.

ICO Risks

Notwithstanding regulatory uncertainty, the largest risks with ICOs still center on scams and rug pulls, in which the project leaders simply disappear with the money. Less nefarious but often equally devastating for investors, the project developers may fail to execute on stated goals.

Fraud and rug pull run rampant in the space, particularly for smaller projects. In 2021, a cofounder of Centra Tech was sentenced to eight years in prison after holding an ICO for a company that purported to offer financial services, including a debit card. The SEC also charged Boxer Floyd Mayweather Jr. and music producer Khaled Khaled for allegedly failing to disclose payments received to promote the CTR token.

Volatility also brings risks for ICO investors. Projects with a smaller market cap can be subject to more volatile price action and even price manipulation. As projects mature and the market cap grows, manipulation becomes more costly, reducing the risk from that vector. However, each project still faces a crowded field of competitors.

The Bottom Line

Initial coin offerings provide a way for projects to get fast funding while also offering investors speculative investments that could deliver impressive returns. However, the space still remains largely unregulated, leaving room for fraudulent actors.

Newer strategies, such as Decentralized Autonomous ICOs, could help maintain a safer environment for investors while also providing much-needed funding for new projects.

FAQs

What is an Initial Coin Offering in simple terms?

What are the risks of an Initial Coin Offering?

What is the difference between IPO and ICO?

Can US citizens participate in ICOs?

References

- Ethereum ICO Participant Transfers $116M ETH After 8 Years of Dormancy (Finance.yahoo)

- $225 Million Raised in Wormhole Token Sales (Wormhole)

- Cardano Tokenomics | CoinGecko (Coingecko)

- History of Crypto: The ICO Boom and Ethereum’s Evolution (Cointelegraph)

- Solana Tokenomics | CoinGecko (Coingecko)

- Impossible Finance – DeFi made impossibly easy (Impossible)

- SEC.gov | SEC Orders Blockchain Company to Pay $24 Million Penalty for Unregistered ICO (Sec)

- Cardano (ADA) ICO – Rating, News & Details | CoinCodex (Coincodex)

- SEC wins injunction against Telegram blockchain launch in key ICO case | Reuters (Reuters)

- elegram to Return $1.2 Billion to Investors and Pay $18.5 Million Penalty to Settle SEC Charges (Sec)

- SEC.gov | Cryptocurrency/ICOs (Sec)

- ICOs – a crypto conundrum | International Bar Association (Ibanet)

- Leading Co-Founder Of Cryptocurrency Company Sentenced To 8 Years In Prison For ICO Fraud Scheme (Justice)

- Two Celebrities Charged With Unlawfully Touting Coin Offerings (Sec)