What is a Hurdle Rate?

A hurdle rate is the minimum return that investors are willing to accept on a particular investment that they’ve made. It’s also known as the minimum acceptable rate of return (MARR) and is a calculation that takes into account a number of important financial factors.

The hurdle rate will be used by investors to weigh up how much return they need, and companies to assess the viability of particular projects.

Key Takeaways

- It refers to the minimum acceptable return that investors can expect on a particular investment they’ve made.

- Another term for hurdle rate is a minimum acceptable rate of return (MARR).

- A hurdle rate is determined by taking into account factors such as the cost of capital, current opportunities, and the rates generated by similar investments.

- In broad terms, the higher the risk involved in a project, the higher the hurdle rate is likely to be.

- A hurdle rate must not be confused with an Internal Rate of Return (IRR), as the latter looks at the actual rate of return generated by an investment.

- Show Full Guide

How to Use Hurdle Rate

So, who uses a hurdle rate? There are two main groups of people:

- Investors looking to make money

- Managers assessing the viability of a project

The benefit of a hurdle rate is that it gives individuals and businesses an idea as to whether or not a particular investment will be a success. This enables them to make crucial decisions as to whether a planned project is viable and worthy of the required injection of capital.

The hurdle rate calculation will influence the next move. For example, if the expected rate of return is above the hurdle rate, then the investment will be regarded as attractive.

Conversely, if the expected rate of return is below the hurdle rate, then that sends a clear signal to investors and managers that it’s not worth pursuing.

Hurdle Rate vs. Internal Rate of Return

It’s a common misconception but these two terms are not the same. Hurdle rate refers to the specific minimum acceptable return on an investment.

The Internal Rate of Return (IRR), meanwhile, is the actual rate of return that’s earned by the investment. Naturally, this may be either above or below the hurdle rate.

At its core, the IRR represents the annualized rate of return that would make the net present value (NPV) of all cash flows from a project equal to zero.

You can learn more about how the IRR works here.

Methods Used to Determine a Hurdle Rate

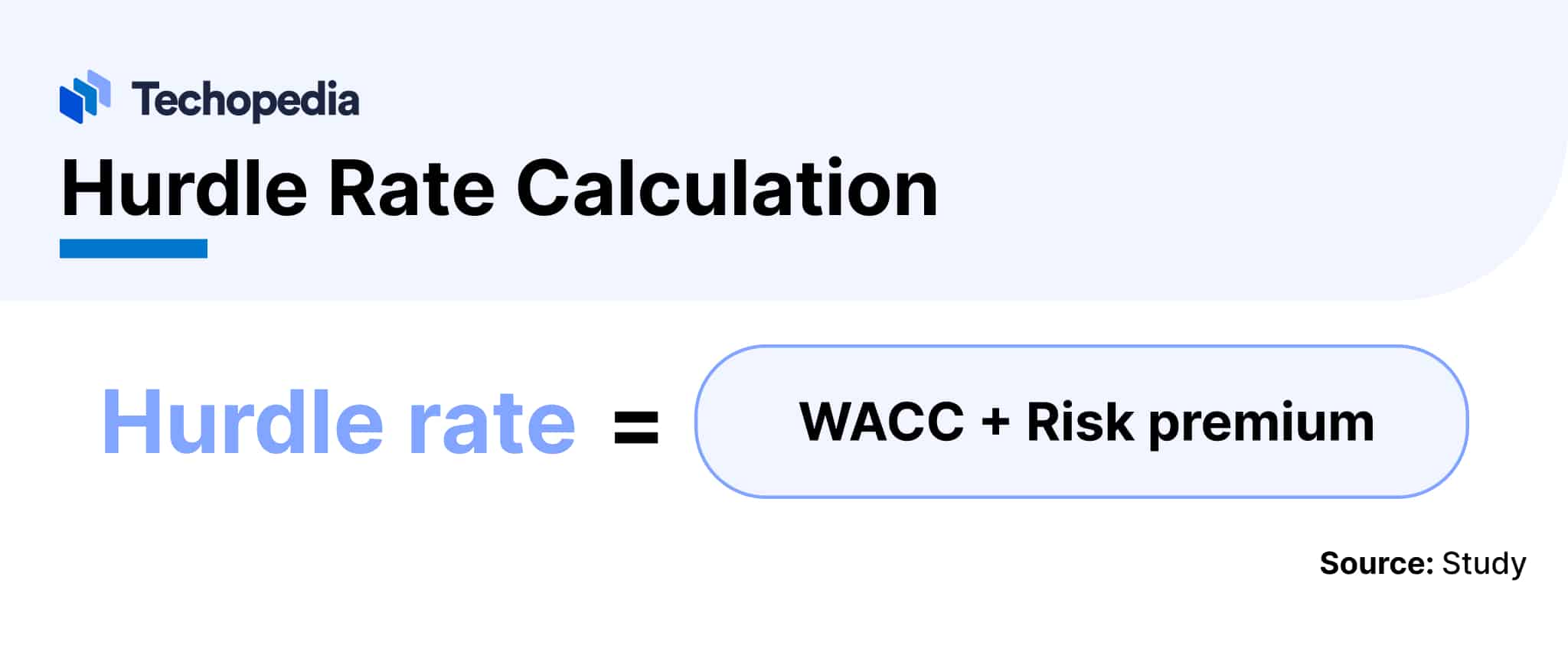

There are several methods to determine a hurdle rate. However, one of the most common is by using what is known as the weighted average cost of capital (WACC).

Before we move on to calculating hurdle rates, it’s important to become familiar with both WACC and risk premium.

The term WACC refers to the cost of capital to the company from the various sources that have been tapped. This gives a very basic outline of the return required to cover the capital cost.

The definition of risk premium, meanwhile, is the percentage that is added to the WACC that takes into account the increased risk that would be taken.

How to Calculate a Hurdle Rate

The next stage is looking at how to calculate the hurdle rate. One popular way it’s worked out is by adding a risk premium to the weighted average cost of capital.

Hurdle Rate Example

Let’s use this formula on a fictional company investment to illustrate how a hurdle rate can be established.

In our example, company A has a WACC of 5% and has attached a risk premium for the project of 3%.

Adding the WACC to the risk premium will give the management team a hurdle rate of at least 8%. This will be the minimum acceptable return.

Evaluating Investment With Hurdle Rate

A hurdle rate is used by businesses to determine whether a particular project under consideration is economically viable. No manager wants to invest a small fortune into something only to find that the rate of return means the chances of making a profit are remote. That’s why it makes sense to have in mind the lowest acceptable return that would be needed to make it worth everyone’s while.

Hurdle rates are used by almost a third of firms, according to a macroeconomic blog written by staff at the Bank of England. Its research found the use of hurdle rates is most common among firms operating in the real estate sector, with 45% of firms reporting that they have one in place.

Elsewhere, 37% of manufacturing firms used them, whereas only 12% of firms in the other services sector and 20% in sectors such as professional and scientific services.

It stated: “This difference suggests that hurdle rates are more commonly used by firms making tangible investments. Larger firms are also more likely to use hurdle rates than smaller firms.”

Of course, what constitutes an acceptable hurdle rate will depend on what is being assessed and the type of investment. For example, what is the hurdle rate in private equity? Generally, the answer is that it’s around the 7-8% mark.

8 Factors To Consider When Setting a Hurdle Rate

There are a number of factors that you need to bear in mind when setting a hurdle rate:

- Cost of capital

- The risk associated with the investment

- The investment climate

- Rate of inflation

- Interest rates

- Opportunities for business expansion

- Political instability

- Strategic alignment

Limitations of a Hurdle Rate

While a hurdle rate can be a useful financial metric, there are some potential disadvantages that need to be considered:

The Bottom Line

The hurdle rate definition refers to the minimum return that investors are willing to accept on a particular investment that they’ve made. It’s also used by businesses who want to assess whether the likely return is enough for them to give the green light to a project.

This means it’s a very useful metric. However, it does have its limitations and should only be used in conjunction with other factors in the decision-making process.