What is the House Price Index (HPI)?

The FHFA house price index (HPI) is a broad economic measure that charts the movement of single-family house prices in the United States.

It highlights changes in the average price of sales or refinancings on the same properties to give an insight into how the housing market is performing.

Key Takeaways

- The house price index is a broad measure of the movement in single-family house prices in the United States.

- It is a key indicator that investors, analysts, and homebuyers can use to assess and monitor economic trends.

- The HPI is published by the Federal Housing Finance Agency (FHFA), which examines data on both a monthly and quarterly basis.

- It is one of several indices used to analyze the US real estate market, and its data goes back many years.

- It’s possible to use an online calculator to estimate how much a house bought years ago could be worth today.

How the House Price Index is Used

The next stage is looking at the role played by the US house price index and why it is an important economic measure for many people.

Information about the demand for homes and the prices paid for them provides a useful insight into the economic wealth of a country. It can be used to assess feelings of optimism among buyers and sellers, as well as help shine a spotlight on affordability and the impact of inflation.

Therefore, the data provided by the HPI will be used by economists and analysts, as well as anyone interested in how property values are rising and falling, such as realtors.

The House Price Index vs. the S&P CoreLogic Case-Shiller Home Price Indexes

There are numerous indices and analytical reports published by different organizations to monitor and assess the US real estate market. They will all take slightly different approaches, which makes it difficult to answer the question: “What is the most accurate house price index?”

Here we take a closer look at both the FHFA house price index and the S&P CoreLogic Case-Shiller Home Price Index.

FHFA House Price Index (HPI)

So, as far as the FHFA version is concerned, how is the HPI calculated? The index measures average price changes in sales or refinancings on the same properties.

This information is obtained by reviewing transactions made on single-family properties with mortgages purchased (or securitized) by Fannie Mae or Freddie Mac.

It’s also worth noting that new mortgage acquisitions are used to identify repeat transactions for the most recent period, as well as each subsequent period since 1975.

Now, the HPI actually refers to the whole suite of indices that are compiled by FHFA, covering a variety of market geographies and periods. It releases monthly and quarterly reports.

S&P CoreLogic Case-Shiller Home Price Index

The S&P CoreLogic Case-Shiller Home Price Index is another leading measure of US residential real estate prices.

It is a family of indices that tracks changes in the value of residential real estate for the nine US Census divisions and is calculated on a monthly basis.

It’s designed to measure movements in the total value of all existing single-family housing stock by using samples and relevant transaction data.

However, it doesn’t include sample sale prices associated with new construction, condominiums, co-ops/apartments, and multi-family dwellings.

House Price Index Example

So, how does the HPI work in reality?

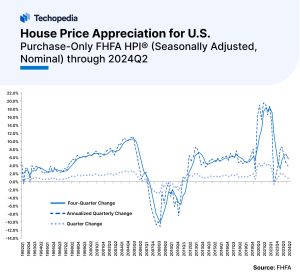

Let’s take the most recent FHFA house price index, which was published in late August 2024 and covers the second quarter of 2024.

The quarterly data revealed prices were 0.9% higher than the first quarter of 2024 and had risen 5.7% over the last year.

Its findings included:

- The US housing market has experienced positive annual appreciation in each quarter since the start of 2012

- House prices rose in 50 states and the District of Columbia between the second quarter of 2023 and the same period in 2024

- House prices rose in 96 of the top 100 largest metropolitan areas over the last four quarters

Dr Anju Vajja, Deputy Director for FHFA’s Division of Research and Statistics, noted that US house prices had experienced their third consecutive slowdown in quarterly growth.

He said: “The slower pace of appreciation as of June end was likely due to higher inventory of homes for sale and elevated mortgage rates.”

Here is a house price index chart that charts house price appreciation in the US from the first quarter of 1992 to the second quarter of 2024.

FHFA House Price Index Calculator

There is also a way of estimating the likely value of a particular property by using this online FHFA calculator. However, this doesn’t project the value of individual properties as these can be affected by factors such as the local area and the house’s age/condition.

Instead, the calculator forecasts what a house purchased at a set time would be worth today if it rose at the average appreciation rate of all homes in the area.

Users need to input where the house was purchased, the price paid, and the period for which they want a valuation.

The Bottom Line

The clearest house price index definition is that it measures movements in the value of US homes and provides data to interested parties. The movement in house prices is of importance to millions of people around the world as their homes are likely to be the biggest purchase they ever make.

First-time buyers who want to get onto the property ladder will want to know whether prices are likely to rise over the coming months. Similarly, existing homeowners will be keen to gauge how much more their property is worth today than when they first moved in.

However, analysts, economists, fund managers, and politicians also use the HPI as a key economic indicator because of the insight it can provide into our financial health.